Navy Federal EFTA Settlement: The Breakdown for Members

The "Win" That Ain't One

Alright, let's cut through the corporate-speak and the legal jargon, because honestly, my eyes start to glaze over faster than a politician at a truth convention. Navy Federal Credit Union, that behemoth supposedly looking out for our military families, just coughed up $1.7 million. A settlement, they call it. For what? For allegedly denying claims for unauthorized electronic transfers without bothering to explain why and then, get this, failing to give folks the documents they asked for. You know, basic transparency stuff that's legally mandated by the Electronic Funds Transfer Act. It's like they thought the rules were just... suggestions.

NFCU, of course, denies any wrongdoing. Of course they do. They always do. But they settled to "avoid the costs, delays, and uncertainties of continued litigation." Translation: "We probably would've lost, or it would've cost us way more to drag this out, so here's a relatively small check to make it go away." It's the classic corporate playbook, ain't it? Get caught with your hand in the cookie jar, deny everything, then offer a crumb as a peace offering. My guess is, somewhere in a glass tower, a bunch of suits are clinking champagne glasses over this deal. It's less a "win" for consumers and more like a company buying its way out of a much bigger headache. This isn't just a misstep. No, "misstep" is too gentle—it's a systemic shrug at the very people they claim to serve.

Think about that for a second. We're talking about military members, veterans, their families. People who are often deployed, moving around, relying on digital transactions more than most. They put their trust, and their money, into an institution that’s supposed to protect it. And then, when something goes sideways, when their money vanishes, they get stonewalled. I can just picture some exhausted servicemember, trying to sort out a fraudulent charge between deployments, staring at a vague denial letter, probably after waiting on hold for an hour, and thinking, "What the hell am I supposed to do now?" The sheer frustration of that situation, the feeling of being powerless against a giant institution, that's the real cost here, not just the dollar amount on the settlement check. It’s like trying to fight a ghost in a suit.

The Fine Print and the Real Cost

So, $1.7 million. Sounds like a lot, right? Until you peel back the layers. First, the lawyers get their cut – up to a cool $566,667. Then there are legal costs, settlement administration, and a $5,000 service award for each of the two class representatives. Good for them, I guess, for sticking it out. But what's left for the thousands, maybe tens of thousands, of actual account holders whose claims were denied between October 2022 and August 2025? It’s a huge window, meaning the individual payouts are gonna be what they always are in these situations: a pittance. A few bucks, maybe a twenty if you're lucky. It's hardly going to make anyone whole, is it? It's more of a symbolic gesture, a corporate "Sorry, not sorry" delivered via a check that barely covers a decent meal.

They're also promising "policy changes" – clearer denial notices, better procedures for document requests. Fantastic. But why did it take a lawsuit, a federal act, and a public shaming to get them to do the right thing? This isn't groundbreaking stuff; it's basic customer service and legal compliance. It’s like a restaurant promising to wash its dishes after a health inspector finds a rat in the kitchen. You gotta wonder, what else are they cutting corners on? What other "unauthorized transfers" are slipping through the cracks, or being denied, because people don't have the time, the energy, or the resources to join a class-action lawsuit? We're talking about a credit union with over 12 million members and assets exceeding $162 billion. $1.7 million is a rounding error for them. It's a parking ticket. A minor annoyance. And honestly, it makes me wonder if these "policy changes" are just for show, a temporary fix until the next scandal blows over. Do they actually expect us to believe this changes anything fundamentally, or just until the next class action?

I mean, let's be real. When an institution this massive, built on the trust of military families, gets caught, it's not just about the money. It's about the erosion of trust. It's about the feeling that even the places designed to protect you are just another corporate entity playing by its own rules until a judge says otherwise. Then again, maybe I'm just the crazy one here. Maybe a few bucks and a promise to "do better" is all we should expect. It's hard not to feel cynical when the system seems rigged this way, isn't it?

Just Another Day at the Corporate Office

This whole thing smells like a cost of doing business, not a genuine reckoning. Navy Federal gets to save face, avoid a protracted legal battle, and pay what amounts to chump change to resolve a problem that affected a huge swath of its most vulnerable members. The lawyers get rich, the class reps get a bonus, and the actual victims get a token payment and a promise that maybe, just maybe, things will be a little less shady next time. It's not justice; it's damage control. And it makes me question, deeply, what "consumer protection" really means when the institutions we're supposed to trust can just buy their way out of accountability.

Related Articles

MP Materials Stock Analysis: The Data Behind the 'Hold' Rating

The stock chart for MP Materials (MP) over the last 90 days looks less like a valuation curve and mo...

The Fed's Latest Rate Cut: What It *Really* Means for the Future of Innovation

The Federal Reserve is flying blind. That’s not my assessment. That’s the word on the street from ec...

The ASML Stock Frenzy: Why Everyone's Suddenly Obsessed and What They're Not Telling You

Let's get one thing straight. Every time I see a headline about ASML’s stock climbing another few pe...

Cloud Investments: Reality vs. Hype and What We Know

Generated Title: Kyndryl's Cloud Bet: Savvy Move or Desperate Gamble? Kyndryl, formerly IBM’s infras...

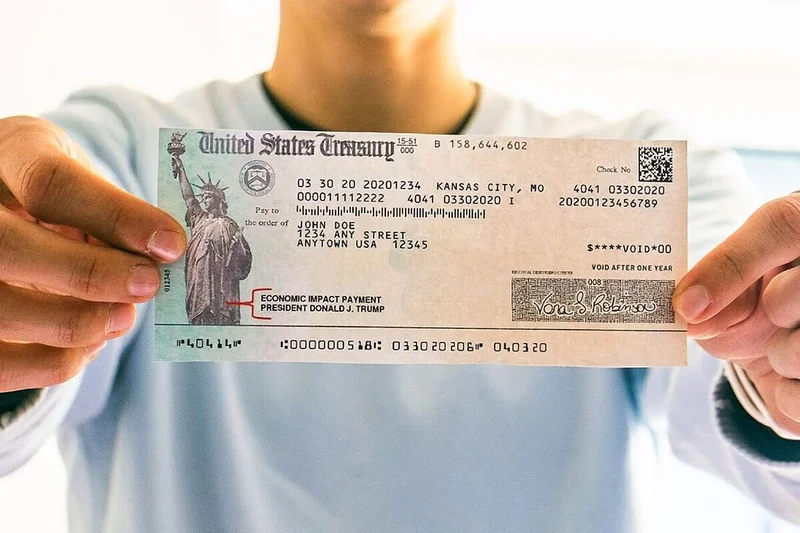

IRS Stimulus Checks 2025: What We Know

Another Stimulus Check? Don't Bet Your Bitcoin On It The internet's buzzing again with rumors of ano...

Powell's Speech: Decoding the Market Impact and Future Rate Cuts

All eyes are on Washington, D.C. tomorrow. Not on Congress, not on the White House, but on a single...